Commercial mortgage agreements often contain specific provisions to protect lenders’ financial interests. One such provision is a prepayment penalty known as yield maintenance. This penalty is designed to ensure that the lender receives the expected return on investment, even if the borrower chooses to pay off the loan ahead of schedule.

Understanding Yield Maintenance

In the realm of commercial real estate lending, yield maintenance is a financial safeguard that compensates the lender for the interest income lost when a loan is paid off early. As a form of prepayment penalty, it serves to reduce the lender’s exposure to the risk of early repayment. Lenders often implement this clause to dissuade borrowers from settling their loans before the agreed term, preserving the expected interest revenue.

This mechanism guarantees that the lender or investor continues to receive the same returns they would have earned had the borrower made every scheduled payment up to the maturity date. The borrower is typically required to pay the difference between the agreed loan interest rate and current market rates, applied to the remaining balance being prepaid. This ensures the lender remains financially whole despite the premature payoff.

The Mechanics of Yield Maintenance

Let’s take a closer look at how yield maintenance functions. When a borrower takes out a commercial mortgage, the lender earns interest as compensation for providing capital. This interest represents the lender’s return on investment, expected consistently over the life of the loan.

If the borrower repays the loan early, the lender no longer receives these payments, disrupting income projections. To offset this, the lender may impose a prepayment fee, commonly known as yield maintenance. This fee allows the lender to recover the original yield they anticipated, ensuring they do not suffer a financial shortfall.

Yield maintenance typically includes two parts:

- Unpaid Principal Balance – The remaining loan amount the borrower owes.

- Prepayment Fee – A financial charge for paying the loan off before maturity.

Unpaid Principal Balance

This refers to the outstanding amount on the loan. For instance, if the original loan was $500,000 and the borrower has repaid $100,000, the unpaid balance is $400,000.

Prepayment Fee

This is a fee outlined in the mortgage contract, activated when a borrower pays off their loan ahead of schedule. Its purpose is to make refinancing or early repayment less appealing, thereby safeguarding the lender’s expected interest income.

Yield Maintenance Period

The yield maintenance period specifies the duration during which a prepayment penalty applies. For example, a 30-year loan might include a yield maintenance clause valid for the first 10 years. If the borrower pays off the loan within that initial decade, the fee applies. This structure discourages early refinancing and helps preserve the lender’s projected returns.

How to Calculate Yield Maintenance

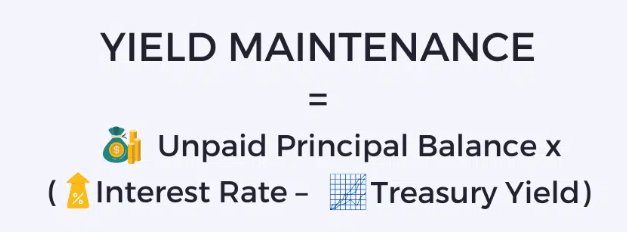

Calculating this penalty can be complex, but it’s possible using a formula or a yield maintenance calculator. The formula is:

Yield Maintenance = Present Value of Remaining Balance × (Loan Interest Rate – Treasury Yield)

To compute the present value:

Where:

- r = current Treasury yield

- n = number of months remaining on the loan

Using a calculator simplifies this process and can help borrowers decide whether early repayment makes financial sense—such as refinancing at a lower interest rate.

Yield Maintenance vs. Defeasance

Both yield maintenance and defeasance allow borrowers to remove liens from commercial properties before loan maturity, but they work differently.

- Yield Maintenance involves direct loan repayment along with a penalty.

- Defeasance involves replacing the collateral and assigning the loan to a new borrower.

Defeasance typically includes purchasing a portfolio of bonds that match the loan’s remaining payments, along with higher transaction fees paid to third parties. In contrast, yield maintenance is often simpler and more cost-effective.

Is Yield Maintenance the Right Fit?

For borrowers, reducing expenses and avoiding risk is key. Many enter long-term commercial loans planning to hold them to maturity or until a property sale. However, failing to consider prepayment penalties could make early repayment costly.

If a borrower doesn’t intend to hold the property long term, a loan with yield maintenance could become expensive if paid off early. Still, loans with shorter yield maintenance periods—such as those ending six months before maturity—can result in lower interest rates and closing costs, benefiting both parties.

Before committing to early repayment, borrowers should weigh the potential penalties carefully. Understanding yield maintenance and its financial impact is essential for making informed, strategic decisions.