For real estate investors, mastering the financial aspects of any transaction is essential to evaluating its potential success. Often, the primary concern is whether the return on investment justifies the costs, particularly when it comes to debt service. One key metric used to assess this is the mortgage constant, which helps determine the cost of debt service and evaluate whether a transaction is financially viable.

What is the Mortgage Constant?

The mortgage constant represents the annual debt payment required to service a loan over its entire term. This metric is applicable only to fixed-rate loans, as the constant would vary with adjustable-rate loans.

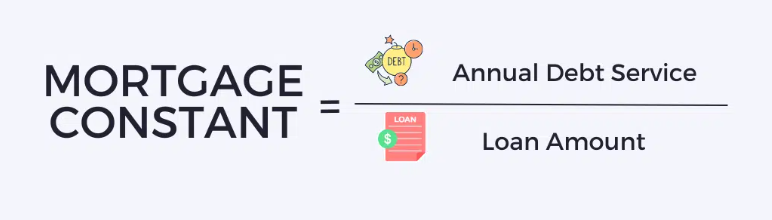

Essentially, the mortgage constant, also known as the loan constant, is the ratio of the annual debt service to the loan amount. Debt service refers to the total amount required to cover both the principal and interest payments on a loan over a specified period.

How to Calculate the Mortgage Constant

The formula for the mortgage constant is straightforward: divide the annual debt service by the total loan amount. To calculate it, investors need to know their debt service—whether it’s for a new loan or an existing one—and then divide that figure by the loan amount.

Mortgage Constant Formula

Mortgage Constant = Annual Debt Service / Loan Amount

Examples of Mortgage Constant Calculation

The mortgage constant varies from one loan to another, but by using current loan terms, it’s possible to determine it for any commercial transaction. For example, consider a 20-year amortizing loan of $1,000,000 with a 6% interest rate. The annual debt service would be $85,972. Dividing this by the $1 million loan amount gives a mortgage constant of approximately 8.6%.

Mortgage Constant vs. Other Property Investment Metrics

While the mortgage constant is a useful tool, it’s just one of several financial metrics investors should consider. Here are comparisons with a few other important metrics:

Mortgage Constant vs. Debt Yield

The mortgage constant helps evaluate a property’s profitability relative to debt costs. In contrast, the debt yield measures the annual income as a percentage of the mortgage amount. A higher debt yield than the mortgage constant suggests positive cash flow and a potentially profitable investment.

Mortgage Constant vs. Cap Rate

The capitalization rate (cap rate) is another critical figure. If the mortgage constant exceeds the cap rate, the property may be losing money. The cap rate is calculated by dividing the net operating income by the property’s market value, providing insight into the property’s value.

Mortgage Constant vs. Interest Rate

The mortgage constant accounts for both the principal and interest payments on a loan, while the interest rate only reflects the cost of borrowing. As a result, the mortgage constant typically provides a more comprehensive view of the loan’s cost.

Applications of the Mortgage Constant in Commercial Real Estate

The mortgage constant is a vital metric for investors and borrowers to consider before committing to a loan. It helps determine the annual amount needed to service the debt, allowing investors to assess whether their cash flow from the property will cover the loan payments.

While the mortgage constant is a valuable tool, it should be considered alongside other financial metrics to make informed investment decisions.

Conclusion

When evaluating a commercial real estate investment, it’s crucial to assess both the mortgage costs and the property’s operating expenses. The mortgage constant provides insight into potential profitability but should be viewed as part of a broader analysis. By considering all relevant factors, investors can better determine whether a transaction aligns with their financial goals.