What Is Equity Multiple?

Equity multiple is a key metric used to measure the overall return on an investment. It’s particularly popular in private equity and commercial real estate because it offers a straightforward way to gauge performance. Few metrics offer such a simple calculation to determine how much an investment might yield—or has yielded—relative to the amount invested.

The Concept Behind Equity Multiple

At its core, the equity multiple expresses how much investors earn in relation to their original investment. It indicates how much the initial equity has been multiplied by the end of the investment period. Essentially, it shows how much value has been generated for each dollar invested.

How It’s Applied in Commercial Real Estate

Equity multiple is frequently used in evaluating both projected and historical performance in real estate and equity deals. Whether you’re analyzing a new opportunity or reviewing the performance of a completed one, this metric gives a quick snapshot of total return. It considers both cash flow during the holding period and appreciation at the time of sale, compared to the capital invested by stakeholders.

Calculating Equity Multiple in Real Estate

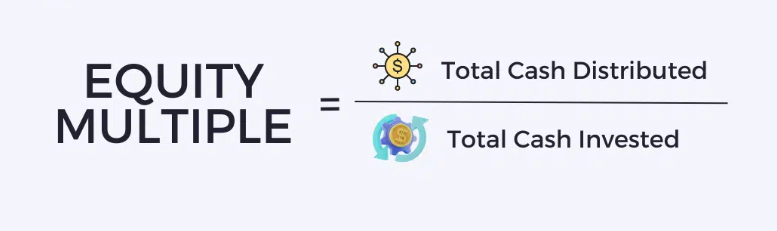

One of the main advantages of equity multiple is its simplicity. Unlike more complex return metrics like IRR, it relies on basic figures and can be quickly calculated:

Formula: Equity Multiple = Total Cash Distributed / Total Cash Invested

Total cash distributed includes all earnings received by investors—such as cash flow distributions, proceeds from refinances or recapitalizations, and the final sale price, including the return of principal.

Total cash invested includes all equity contributed by investors, including the initial investment and any additional funds during the holding period. It excludes financing from loans or reserves not provided by investors.

Example Scenarios

- Example 1: A property bought for $12M involved a $3M equity contribution. It was later sold for $14M, returning $5M to investors, with $500K in cash flow during the hold.

Equity Multiple = ($5M + $500K) / $3M = 1.83

- Example 2: The same investment with an added $1M investor-funded improvement and a $250K distribution from refinancing:

Equity Multiple = ($5M + $500K + $250K) / ($3M + $1M) = 1.44

What’s Considered a Good Equity Multiple?

An equity multiple above 1.0 is generally positive—it means investors earned more than they put in. A multiple of 1.0 means a break-even outcome, while anything below indicates a loss. Beyond that, the definition of a “good” multiple depends on factors like risk, time horizon, and investor preferences. A higher multiple is typically preferred, all else being equal.

Equity Multiple vs. IRR: Key Differences

The primary distinction is that equity multiple doesn’t consider the timing of returns. It treats $1 received today the same as $1 received ten years from now. In contrast, IRR accounts for the time value of money, making it more accurate for comparing investment options with different durations or cash flow timing.

While equity multiple is great for quick comparisons and basic evaluations, IRR provides a deeper look into how fast and efficiently returns are delivered.

Pros and Cons of Equity Multiple

Pros:

- Simple and fast to calculate

- Gives a clear picture of total return

- Useful for quick comparisons

Cons:

- Ignores time and risk factors

- Doesn’t distinguish between short- and long-term gains

Conclusion

Equity multiple offers a fast and effective way to assess the potential or historical profitability of commercial real estate investments. While it shouldn’t be the sole metric used in decision-making, it’s an essential tool for initial screening and understanding whether a deal is financially viable.