Commercial real estate investors need comprehensive information to make informed decisions about their investments. One key metric is the modified internal rate of return (MIRR), which helps investors assess the potential risk and profitability of a property. Understanding how to calculate and interpret MIRR is crucial.

What is Modified Internal Rate of Return (MIRR)?

MIRR is an improved version of the internal rate of return (IRR) that provides a more accurate assessment of an investment’s potential. A higher MIRR indicates a better investment opportunity, while a lower MIRR suggests limited potential. Investors often use MIRR to compare multiple investment opportunities to determine the best long-term returns.

Importance of MIRR

MIRR is essential in capital budgeting for assessing a project’s viability. When the MIRR exceeds the expected return, the investment is attractive. Conversely, a lower MIRR may indicate a less favorable investment. MIRR is more reliable than IRR because it accounts for reinvestment of positive cash flows and uses multi-year data.

Calculating MIRR

To calculate MIRR, consider the following factors:

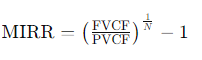

- Future Value of Positive Cash Flow (FVCF): Discounted at the reinvestment rate.

- Present Value of Negative Cash Flow (PVCF): Discounted at the financing cost.

- Number of Investment Periods (N)

MIRR Formula

Gathering all necessary data and applying it to this formula can be complex and prone to errors. Using an MIRR calculator is often a more efficient and accurate method.

MIRR Example

Assume Main Street Investors want to evaluate a $200 million investment in a new manufacturing facility, with a 10% capital cost. The facility is expected to generate $50 million in the first year, $100 million in the second year, and $150 million in the third year. Using the MIRR formula, we determine the MIRR for this project is 17.02%.

Difference Between MIRR and IRR

MIRR addresses IRR’s limitations by assuming reinvestment at an external rate of return, offering a single, clear solution. IRR often provides ambiguous results with two solutions, whereas MIRR gives a more reliable and lower figure, reducing the risk of overestimating returns.

Limitations of MIRR

While MIRR is a valuable tool, it relies on estimates and assumptions, making its accuracy dependent on the quality of the input data. Despite this, MIRR is generally more reliable than IRR for comparing investment projects.

Conclusion

MIRR is a crucial metric for investors comparing projects of different sizes. It corrects common IRR errors and provides a clearer representation of investment opportunities. Using MIRR calculators can enhance accuracy and efficiency in determining the best investment options.