Navigating the financial complexities of commercial real estate investment demands a thorough understanding of the capital involved. At the heart of this process lies the sources and uses statement—a critical financial document that delineates the origin of funds and their intended allocation. This guide is a must-read for every commercial real estate investor seeking to master the art of financial planning and to ensure they meet the expectations of lenders.

The Anatomy of “Sources and Uses” in Commercial Real Estate

The “sources and uses” document is a financial roadmap that pinpoints the capital influx for a project (the “sources”) and delineates how that capital will be allocated (the “uses”). Renowned for its simplicity, the statement provides a high-level snapshot of expected funding and expenditures, often abbreviated as “S&U.”

Structured as a straightforward table, the S&U document offers an easily digestible overview of a project’s financial bearings without delving into granular details.

Capital Streams: The Lifeblood of Commercial Real Estate Projects

The lifeblood of any commercial real estate project is its funding, which can flow from multiple tributaries:

- Owner Equity: Capital injected by project owners or partners.

- Bank Loans: Primary mortgages sourced from financial institutions.

- Sector-Specific Loans: Loans tailored for unique industry segments.

- Hybrid Financing: Instruments blending debt with equity elements.

- Interim Financing: Bridge loans facilitating immediate financing needs.

- Development Financing: Loans specific to new construction or overhaul.

- Vendor Financing: Seller-provided loans, circumventing traditional banks.

- SBA Loans: Small Business Administration-backed financing options.

- Fiscal Awards: Non-repayable government grants.

- Gifted Capital: Non-repayable funds from personal networks.

Expenditure Outline: The “Uses” in the Spotlight

The “uses” section offers a panoramic view of anticipated disbursements, including:

- Asset Acquisition: Payments transacted for property ownership.

- Transaction Costs: Comprehensive closing expenses.

- Operational Capital: Initial management and operational funding.

- Development Outlay: New construction financial requirements.

- Refurbishment Budget: Significant overhaul funding.

- Incidental Expenditures: Legal, consultative, and other sundry fees.

- Emergency Reserves: Funds earmarked for unforeseen costs.

- Mandatory Escrows: Compulsory escrow deposits.

Customization is key; the document tailors its categories to the unique financial contours of each property.

Lenders’ Lens: Why “Sources and Uses” Matters

Lenders champion the sources and uses statement for several pivotal reasons:

- Risk Mitigation: Assesses the financial risks tethered to a project.

- Capital Adequacy: Verifies comprehensive cost coverage.

- Financial Clarity: Illuminates the project’s monetary framework.

- Regulatory Adherence: Fulfills certain legal financial stipulations.

Crafting Your Sources and Uses Statement

Constructing a sources and uses statement is a meticulous process of financial reconciliation. Here’s how to distill your project’s financial essence:

- Catalogue Capital Origins: Identify and list every conceivable funding source.

- Enumerate Anticipated Expenses: Articulate each expected financial commitment, ensuring all project facets are covered.

- Balance the Books: Equilibrate total sources with total uses, ensuring fiscal feasibility.

- Reevaluate and Refine: Continuously revisit your financial outline, fine-tuning as project variables evolve.

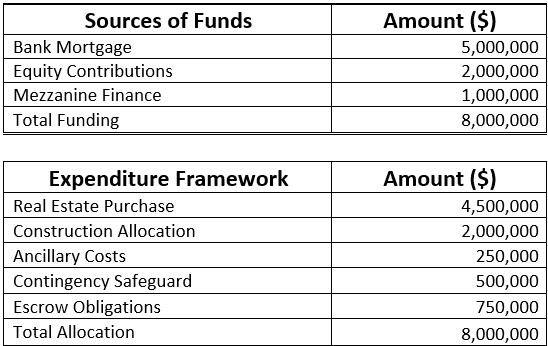

Illustrative S&U Table Snapshot

Consider this specimen S&U table for a clearer understanding:

Conclusion

A sources and uses statement stands as an indispensable tool in the commercial real estate finance arsenal. As you embark on securing financing, you’ll discover that each lender, as well as other invested parties, will prize this document for its clear articulation of your project’s financial strategy. Its creation is not only an exercise in financial planning but a pivotal step towards the successful realization of a commercial real estate venture.